Investing wisely is essential for securing a stable financial future, and understanding various strategies can significantly enhance your approach. Balancing risk and return is crucial, as needs and market conditions evolve over time. By focusing on long-term investment principles, individuals can navigate the complexities of the market and make informed decisions. Whether through automated contributions, diversification, or understanding risk profiles, a well-rounded investment strategy can lead to sustainable growth. Emphasizing patience and discipline in investment choices will ultimately yield the best results.

Steering clear of investments that promise quick riches is crucial for long-term success. Such schemes are often fraught with volatility and scams, leading to potential losses. Instead, focusing on reliable, time-tested investment strategies is essential for building wealth sustainably. Long-term investing emphasizes patience and careful analysis over speculative ventures. By prioritizing sound investment principles, you can create a more secure financial future and avoid the pitfalls of high-risk investments.

Investing in low-cost index funds or ETFs is a smart strategy for long-term investors. These investment vehicles track broad market indices, providing instant diversification while keeping costs low. High fees can erode your investment returns over time, making cost-effective options essential for maximizing growth. Index investing allows you to participate in market performance without the burden of high management fees. This approach is particularly beneficial for those looking to build wealth steadily over time while minimizing expenses.

Being mindful of taxes is essential for optimizing your investment strategy. Taxes can significantly impact your overall returns, making it crucial to develop a tax-efficient financial plan. Collaborating with a knowledgeable advisor can help you navigate the complexities of tax regulations and identify strategies to minimize your tax burden. By incorporating tax considerations into your investment decisions, you can enhance your net returns and achieve your financial goals more effectively. A proactive approach to tax management is vital for long-term investment success.

A Roth IRA is an excellent vehicle for long-term investing, offering tax-free growth for life. Contributions are made with after-tax dollars, allowing for tax-free withdrawals during retirement. This account type also has no required minimum distributions, enabling your investments to grow without interruption. Utilizing a Roth IRA can be a strategic choice for individuals looking to maximize their retirement savings while minimizing tax liabilities. By leveraging this investment option, you can build a substantial nest egg for your future.

Maintaining emotional discipline is crucial for long-term investment success. Investors often face the temptation to react impulsively to market volatility, which can lead to poor decision-making. Sticking to a well-defined investment strategy is essential for navigating the ups and downs of the market. By keeping emotions at bay, you can focus on your long-term goals and avoid the pitfalls of short-term thinking. This approach fosters a more stable investment experience, allowing you to remain committed to your strategy even during turbulent times.

Diversification is a cornerstone of effective long-term investing. By spreading your investments across various asset classes and geographical regions, you can mitigate risks and reduce overall portfolio volatility. A well-diversified portfolio not only includes different types of investments but also aims to balance potential losses with gains from other assets. This strategy helps protect your investments from market downturns and enhances the likelihood of achieving stable returns over time. Emphasizing diversification can lead to a more resilient investment strategy, allowing you to weather market fluctuations more effectively.

Automating your investment contributions can significantly enhance your long-term investment strategy. By setting up a monthly investment plan, you can ensure consistent contributions without the stress of manual management. This approach not only simplifies the investment process but also encourages disciplined saving habits. Automation allows you to take advantage of market fluctuations without emotional interference, as your investments are made regularly regardless of market conditions. Over time, this strategy can lead to substantial wealth accumulation, making it a practical choice for many investors.

Grasping your risk profile is vital for making informed investment decisions. This understanding often comes from personal experience and can evolve over time, particularly as you approach significant life milestones like retirement. Assessing your comfort with risk helps tailor your investment strategy to align with your financial goals and emotional resilience. A well-defined risk profile allows you to choose investments that suit your tolerance for market fluctuations, ensuring a more personalized and effective investment approach. Regularly revisiting your risk profile is essential as your circumstances and market conditions change.

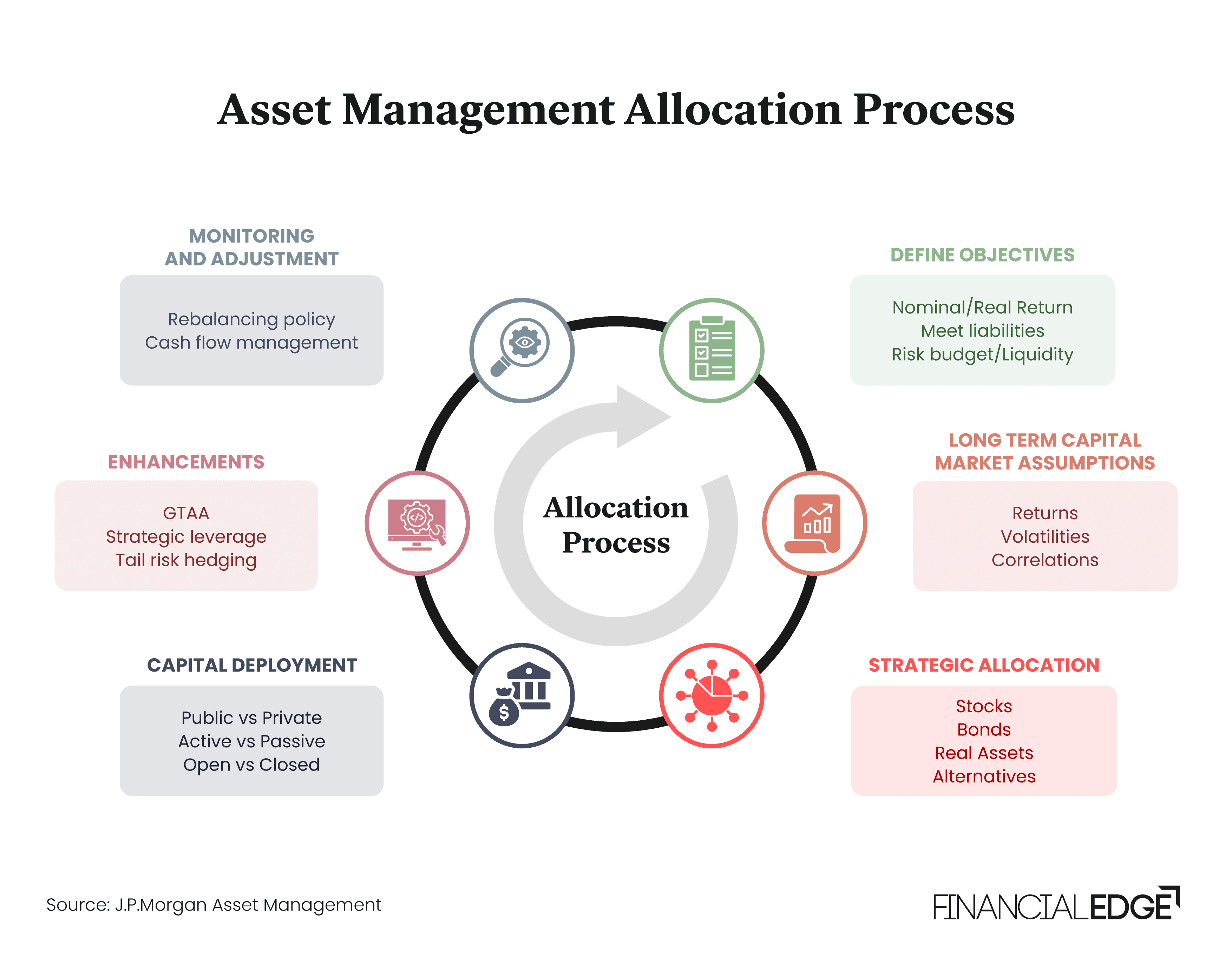

Achieving long-term investment success requires a combination of effective asset allocation and consistent investment practices. Asset allocation involves strategically distributing your investments across various asset classes, such as stocks and bonds, based on your risk tolerance and investment timeline. Consistency, often achieved through methods like dollar-cost averaging, helps mitigate the impact of market volatility. By maintaining a disciplined approach to investing, you can enhance your potential for growth while managing risk effectively. This dual strategy is essential for navigating the complexities of the investment landscape.

Starting your investment journey early is crucial for long-term success. The earlier you begin, the more time your investments have to grow, leveraging the power of compounding. Delaying your investment by even a decade can significantly reduce your potential returns. By initiating your investments sooner, you can take advantage of the exponential growth that occurs over time. This foundational principle emphasizes the importance of time in the investment process, allowing your wealth to accumulate and flourish. Therefore, making the decision to invest early can set the stage for a more secure financial future.